2025

Open Enrollment Presentation

2025

Benefits at a Glance

My Medical Benefits

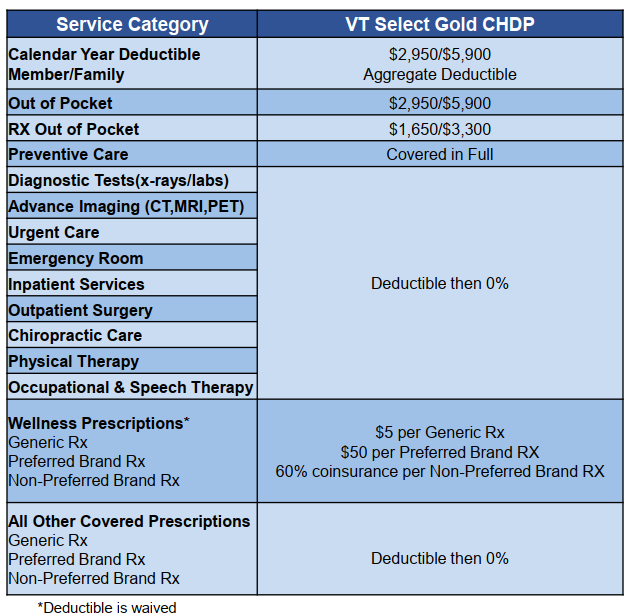

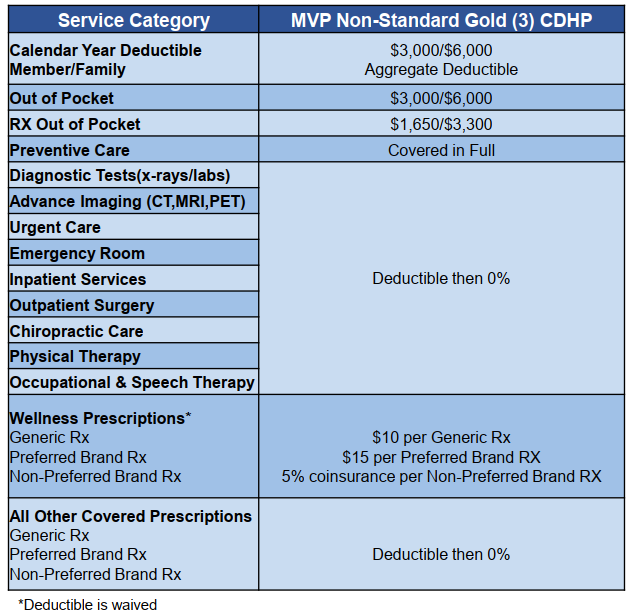

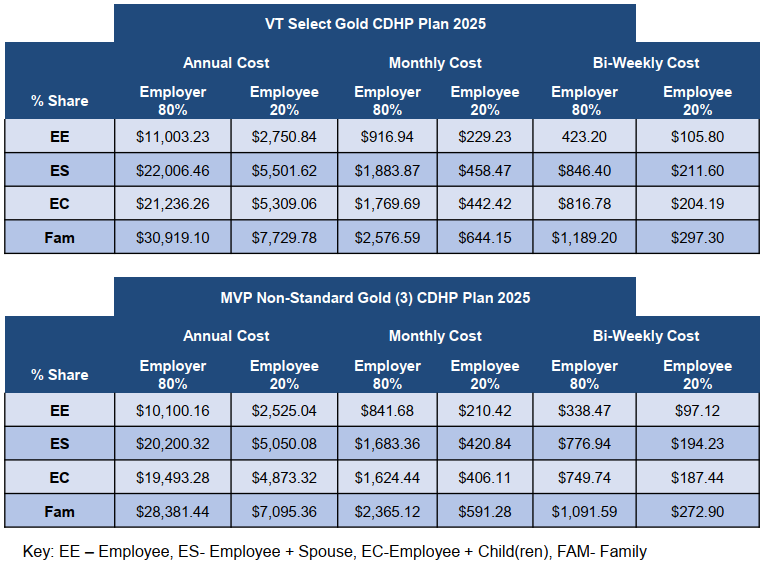

Advance Transit offers tow medical plans: BCBSVT Select Gold CDHP and MVP Non-Standard Gold (3) CDHP.

Contributions

The deductible is the amount you must pay toward the cost of specific services each plan year before BCBSVT or MVP pays for covered services. When someone on an employee-only plan meets the individual deductible, the plan begins to pay that person’s covered services whether they have an aggregate or embedded deductible. But benefits are paid differently for members on a plus spouse, plus children, or family plan depending on whether their plan deductible is aggregate or embedded.

If your plan has an embedded deductible, the plan will begin to pay covered services for an individual member (whether enrolled as EE, ES EC, or Fam) once they have met the individual deductible.

If your plan has an aggregate deductible, the entire family deductible must be met before the plan begins to pay covered services for any member of the family.

Eligibility

Minimum 30 hours per week, effective on the 1st of the month following date of hire.

Blue Cross Blue Shield of Vermont

Medical Insurance

http://www.bcbsvt.com

(800) 247-2583

BCBSVT Wellness Resources

Start by signing up for Be Well Vermont at www.bewellvermont.org. The BCBSVT wellness website offers Quarterly Challenges and Webinars as well as:

- 802Quits: Free tools and support (in-person, phone, or online) to quit tobacco for those age 13 & older.

- BCBSVT Signature Events: Apple Days (fall); Snow Days (winter); Mountain Days (spring); and Hike, Bike & Paddle (summer)

- Wellness Benefits: Nutritional Counseling, Nicotine Replacement Therapy, Lifestyle & Medication Guidance.

Sign up at http://www.bewellvermont.org

Discount Programs for Weight Loss

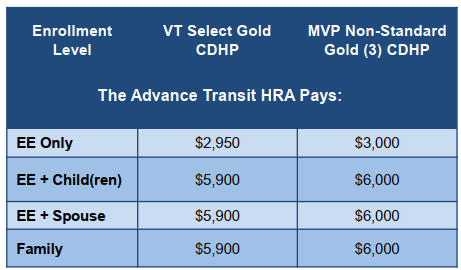

Health Reimbursement Accounts

Health Equity

HRA Administration

http://www.healthequity.com

(877) 713-7709

Flexible Spending Accounts (FSA, DCA)

A Flexible Spending Account provides you an opportunity to pay for health care or dependent care expenses on a pre-tax basis. By anticipating your family’s health care and/or dependent care costs for the next calendar year, you can lower your taxable income.

How it works. Each calendar year, you designate an annual election to be deposited into your health care and/or dependent care accounts. Your annual election will be divided by the number of pay periods in the calendar year and deducted in equal amounts from your paycheck on a pre-tax basis. For health care expenses, you have immediate access to the total amount you elected to contribute for the calendar year. With dependent care, you have access to the amount of the current contributions in your account at the time you request reimbursement.

Maximum Contributions 2025:

Health Care FSA: $3,300 (projected) (with up to $660 rollover allowed into 2026)

Dependent Care FSA: $5,000 for single or married employees filing a combined tax return

$2,500 for married employees filing a separate tax return

Things to consider:

- Your 2025 contributions must be used for expenses you incur between January 1, 2025 – December 31, 2025.

- In order to be eligible for a Dependent Care FSA, your spouse must also be employed or be a full-time student.

- Be conservative when estimating your annual election amount. The IRS has a strict “use it or lose it” rule. You will forfeit any funds left in your account after the end of the calendar year (above the allowed $660 rollover limit for Health Care FSAs).

- You cannot stop or change your FSA contribution during the calendar year unless you have a qualified change in family status.

- Expenses reimbursed through an FSA cannot be used as a deduction or credit on your federal income taxes.

Health Care FSA participants will not receive a new debit card from Health Equity which will allow you to directly pay for FSA-eligible expenses.

Health Equity

FSA, DCA Administration

http://www.healthequity.com

(877) 713-7709

FSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

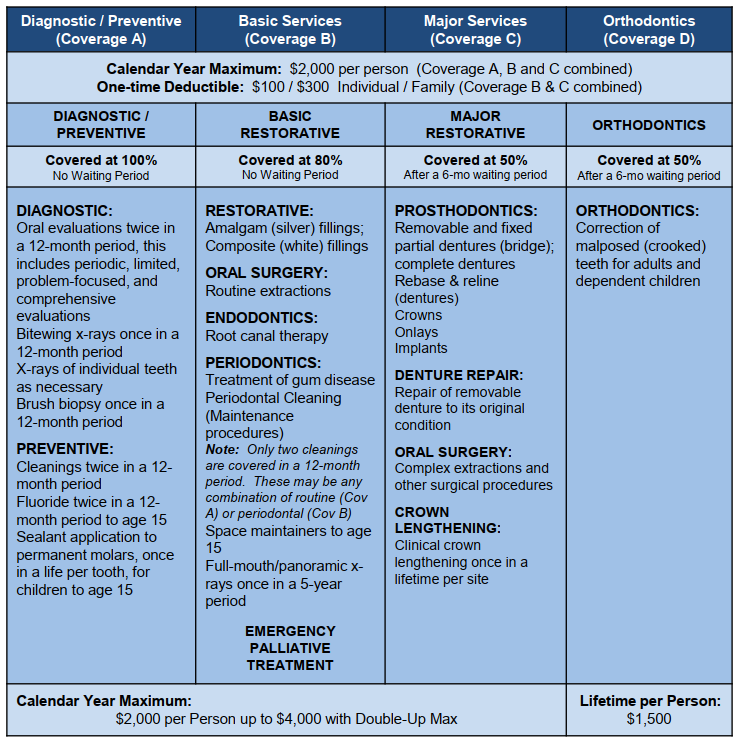

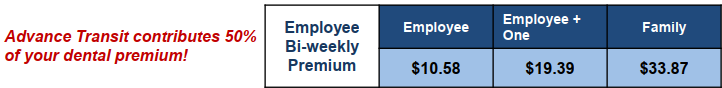

My Dental Benefits

Local Dentist Search – Please be aware that you can choose from PPO or PREMIER networks.

Click on the information below to learn how to get the most out of your Delta Dental plan

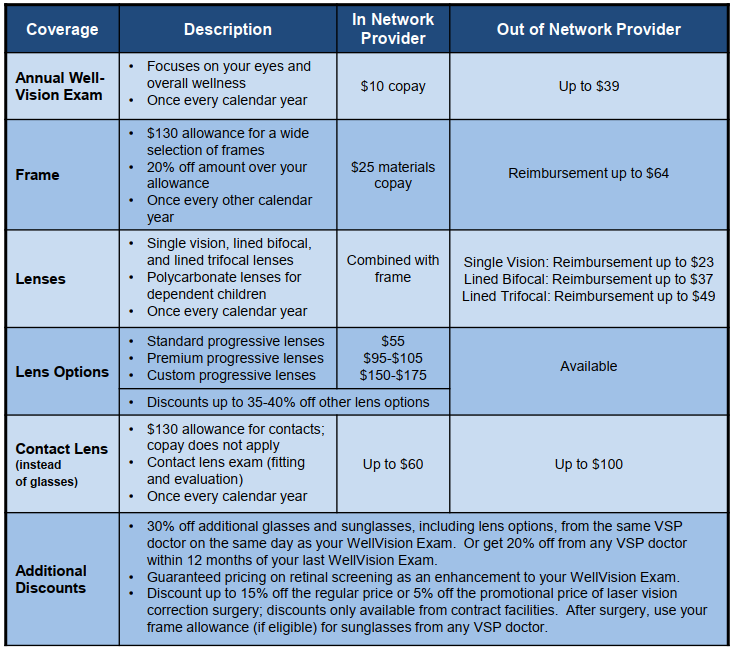

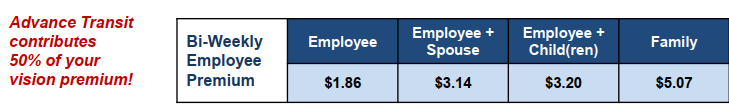

My Vision Benefits

Guardian Vision Plan

Vision Insurance [Plan# 556768]

http://GuardianAnytime.com

(888) 600-1600

Weekdays 8:00am – 8:30pm EST

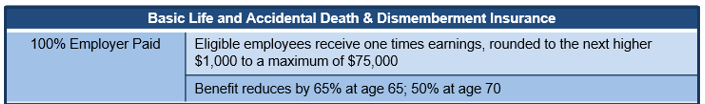

My Life and Disability Benefits

Guardian Life

Life & Disability [Plan# 556768]

http://GuardianAnytime.com

(888) 600-1600

Weekdays 8:00am – 8:30pm EST

Important Documents

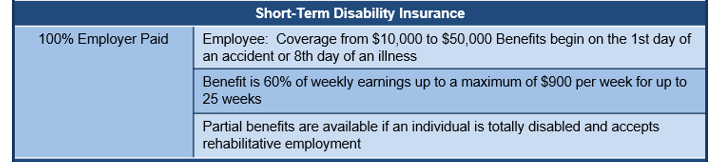

My Short Term Disability Benefits

Guardian Life

Short Term Disability

http://GuardianAnytime.com

(888) 600-1600

Weekdays 8:00am – 8:30pm EST

Important Documents

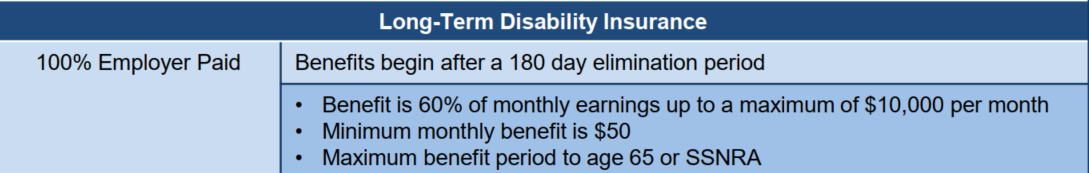

My Long Term Disability Benefits

Guardian Life

Long Term Disability

http://GuardianAnytime.com

(888) 600-1600

Weekdays 8:00am – 8:30pm EST

Important Documents

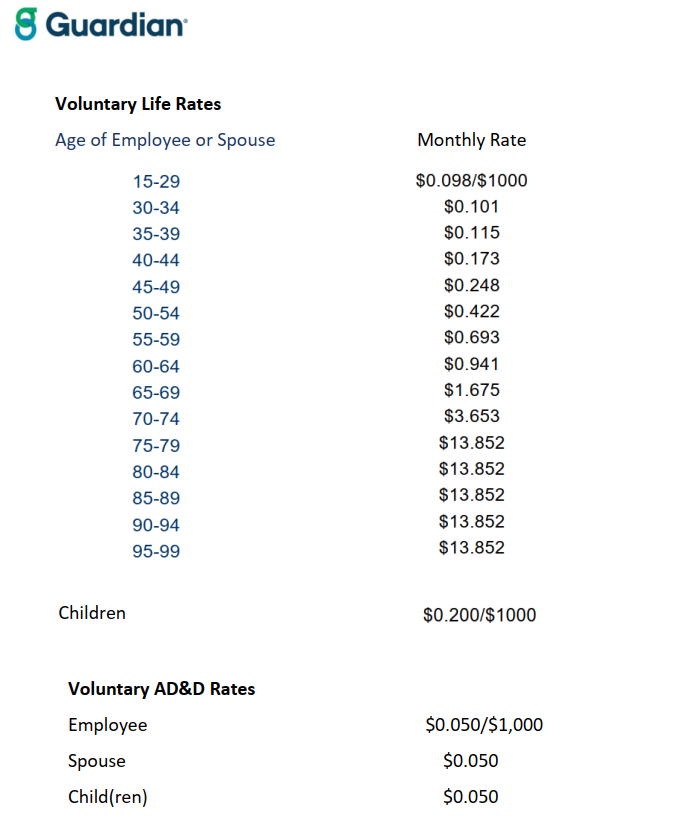

My Voluntary Life & AD&D Benefits

Guardian Life

Voluntary Life & Disability

http://GuardianAnytime.com

(888) 600-1600

Weekdays 8:00am – 8:30pm EST

Important Documents

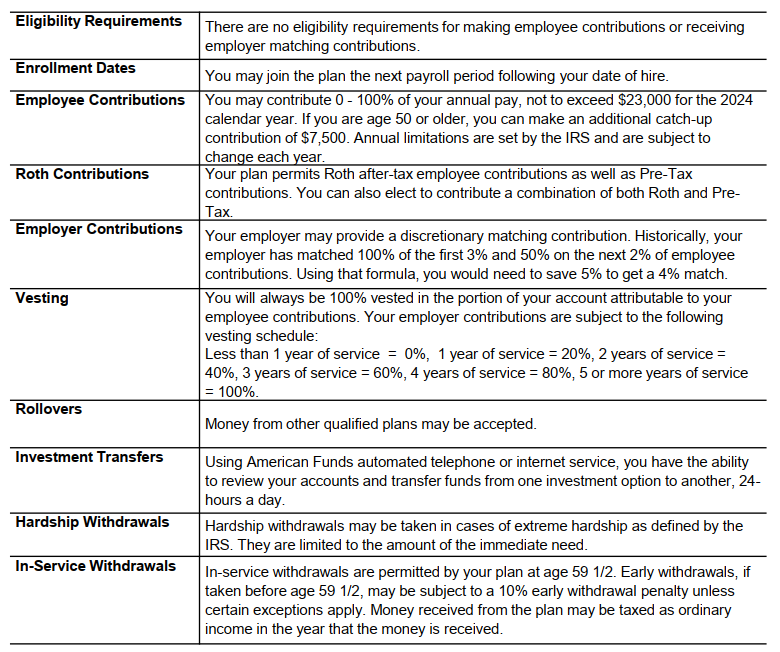

My Retirement Benefits

Advance Transit encourages you to save for retirement. To help you prepare, they offer a 403(b) plan. There are no service requirements for you to enter the plan and elect to make contributions to your 403(b) account via payroll deduction. You can contribute on either a pre-tax or Roth (after-tax) basis. After enrolling, register your account online with American Funds. Establishing online access allows you to utilize the helpful tools, calculators and resources available to help you make informed retirement planning decisions. You can register by going to:

https://americanfunds.retirementpartner.com/participant and clicking on “Register”

Important Information

The Richards Group

TRG Retirement Plan Consultants

helpretire@therichardsgrp.com

802-254-6016

American Funds Retirement

http://americanfunds.retirementpartner.com/participant

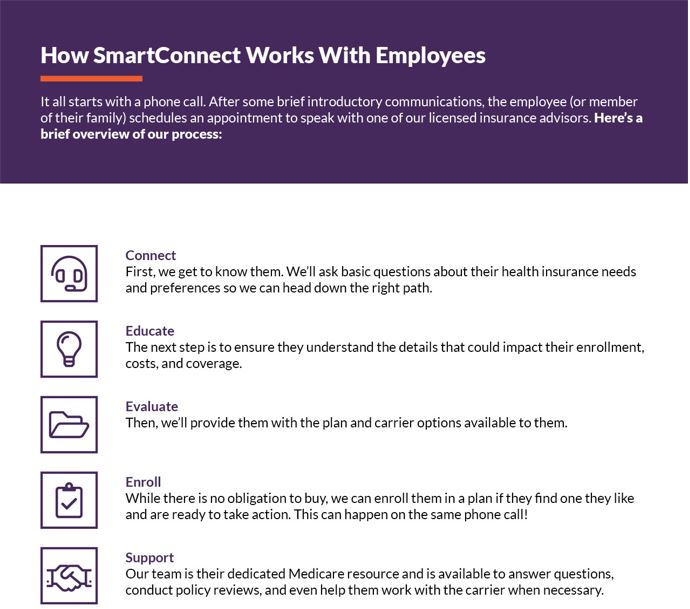

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information

My Tuition Assistance Benefits

The Richard’s Group tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Contact Information

Phone: (844) GRADFIN

For more information or to schedule a one-on-one consultation visit:

Plan Information

My Shopper’s Club Benefits

Advance Transit offers a BJ’s club membership for all employees. With the benefit you can shop at BJ’s or any of its locations. The membership runs from July-June each year.

- Renewal information will be distributed prior to June each year

My Wellness Benefits

Advance Transit will cover 50% of eligible wellness expenses not covered by insurance, up to $250 per year. Proof of expenses must be submitted to HR by the last day of the month. Reimbursement will be processed through payroll as wages and will be taxable. Examples of wellness expenses include:

- Gym memberships

- Classes (online or real-life)

- Workout equipment

- Fitness trackers

- Massage